A survey carried out by 3Gem for Amaiz, the new banking app, has revealed that around a third of micro-business owners are struggling with payment. Nearly 15% still only take cash and of those 31.5% reported that they’d lost a customer because of it. 34.6% of all micro businesses reported that they’d forgotten to invoice a client. For 50% of these business owners the amount lost was at least £250 and nearly 8% reported that they’d lost at least £1,000.

500 micro businesses were asked about their challenges with payment in order to help Amaiz prioritise the services they offer on their new app (launched last year), that combines bookkeeping and banking.

Matt Goddard, Head of Acquisitions at Amaiz explained;

“The UK private sector business population is made up of 3.5 million sole proprietorships in 2019. So if there are 3.5million sole traders in the UK (2019) we can confidently say that if each one of them has forgotten to invoice on average £250 – £500 in the last 12 months, the national figure would be a massive – £875million – 1.7 billion!

“We know that micro businesses and sole traders are working long hours and bookkeeping is an added burden at the end of the working day. Our aim is to reduce that burden, so we carried out the research to ensure we understood their struggles.”

Taking card payment is commonly perceived to be difficult and expensive and invoicing is very easy to forget, if you don’t do it straight away. Businesses who don’t take payment immediately also risk late payment and failure to pay at all.

To solve this problem Amaiz has made it possible for businesses to invoice from the app, while still with the customer. They’ve also partnered with SumUp so they can offer their customers a mobile card reader, with no monthly cost. This makes it possible for payment to be taken immediately and for the business owner to see the money go straight into their account. The card reader is very simple to set up and transaction charges are just 1.69%. The invoicing and card payment facilities automatically record the transaction into the company’s books. These and other features on the Amaiz banking app, have made it possible for bookkeeping to be managed with a few swipes on a smart phone.

Amaiz believe that their payment features will particularly benefit tradespeople (often referred to as ‘white van man’) doing jobs in people’s homes, who, with the new app, can ensure that they get paid before they leave. However, any ‘cash only’ business that is fighting a losing battle with the ‘cash-less society’ will find their card payment solution a very cheap and easy answer to the increasing pressure they’re facing from customers to offer card payment.

Matt concluded;

“Micro businesses are the backbone of Britain’s economy. The Amaiz app will give these businesses back control of their payments.”

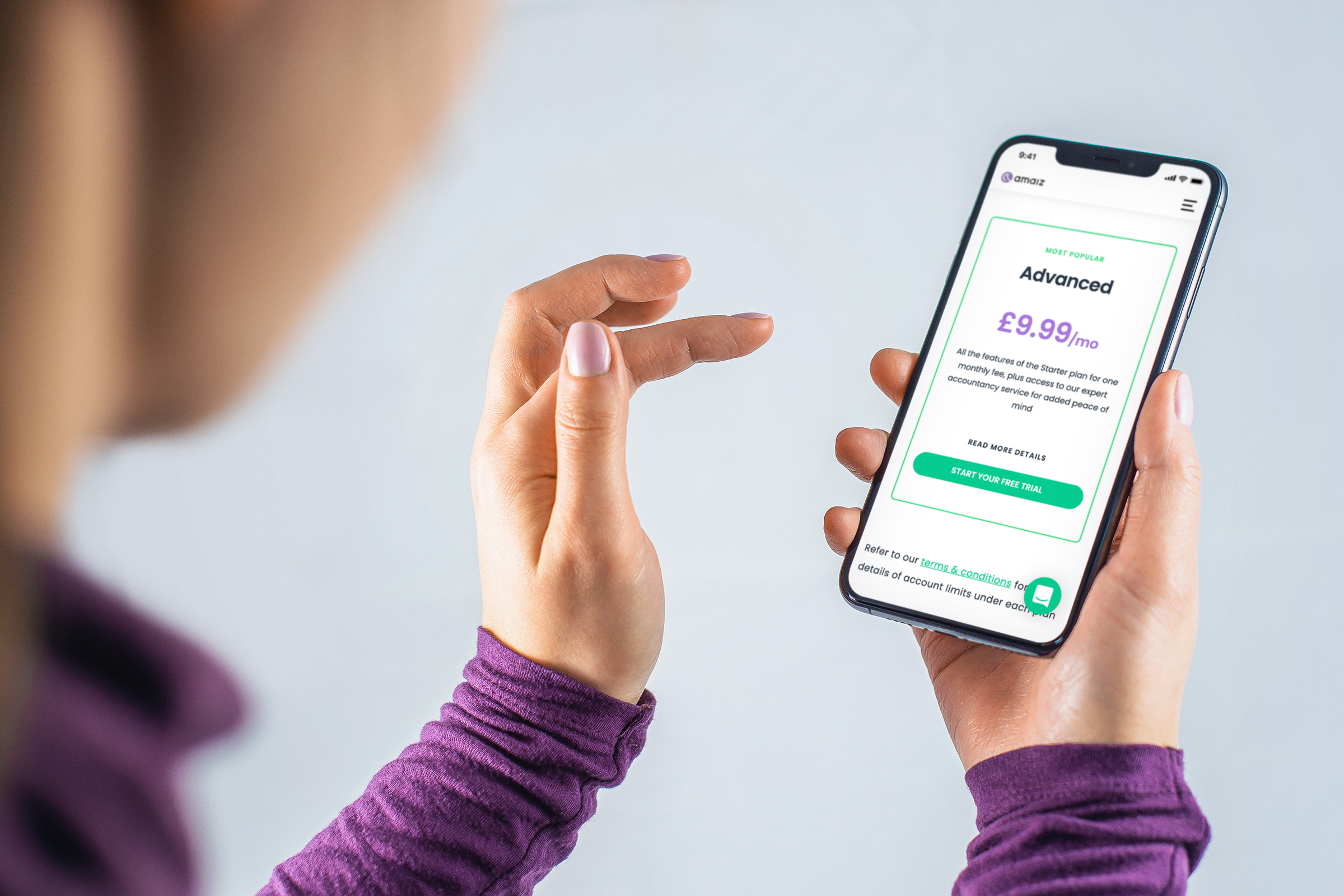

The Amaiz banking app premium account is available at £9.99 per month. However, there is a free version that charges just 20p per transaction. The app comes with numerous unique features that make it possible for business owners to manage their bookkeeping between customers. To set up the account a business owner simply has to download the app then prove their ID and their right to work in the UK. There is no credit check so the process can be done at home very quickly.