The average Brit accrued £2,263 in debt over the last year

Brits estimate they’ve built up £2,263 in personal debt, excluding mortgages, since the first lockdown came into place on 23 March 2020.

In lieu of Debt Awareness Week (22nd – 28th March 2021), research from leading savings site VoucherCodes.co.uk reveals how much debt the nation has accrued over the last year, and investigates the feelings surrounding people’s financial situations.

Over a third (36%) of people have worried about their money every day over the last year. For those that have borrowed money this year, a quarter say they’ve accumulated up to £1,000 in debt (23%), while 15% say they owe up to £2,000, rising to £3,000 for one in 10 people (10%).

The data shows those aged 25-34 have built up the highest amount of debt since lockdown 1.0 began, at an average of £2,673 per person, suggesting that the financial impact of Covid has been felt most strongly by this age group. At the other end of the scale, those over 55 accrued on average £1,777 of debt – the lowest build-up of any age group and almost £1,000 less than millennials.

Total personal debt in the UK is now estimated to sit at £6,338 per person on average, excluding mortgages. Interestingly, the study reveals that women currently owe an average of £5,852 – almost £1,000 less than the average man (£6,854).

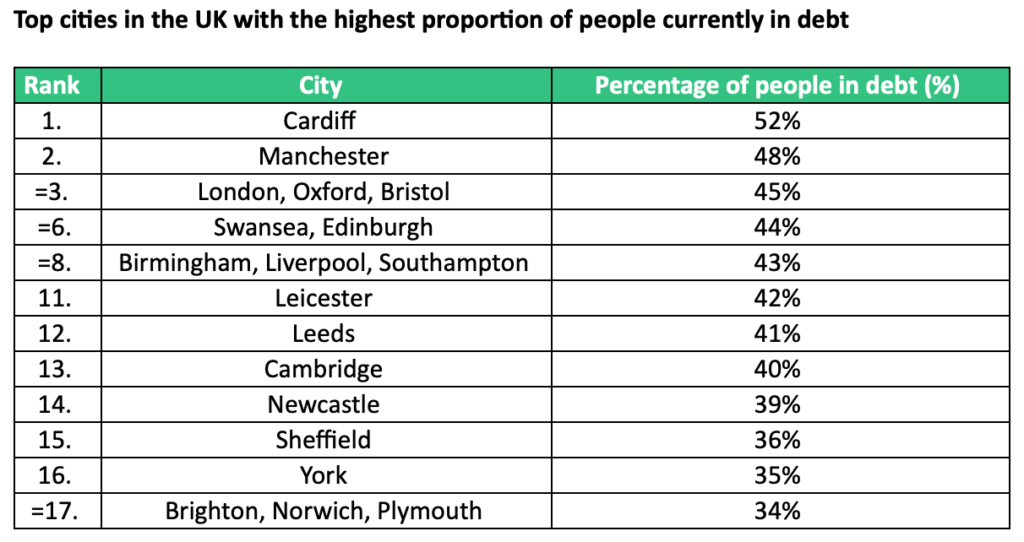

Across the country, findings show that over half (52%) of residents in Cardiff are currently in debt, the highest in the UK. Manchester and London follow closely behind with 48% and 45% respectively. On the other end of the scale are Brighton, Norwich and Plymouth, in which just 34% of residents admit to currently being in debt.

Now Britain’s roadmap out of lockdown has been revealed, many are looking forward to restrictions easing over the coming months, however this study reveals others are worried about the financial implications this will bring. Over a third of people (34%) feel anxious about life returning to ‘normal’ from a financial point of view, as lockdown has meant less of a need to budget. People are also nervous about their total debt levels when lockdown ends as one in 10 even predict that their debt will increase further before the end of lockdown (12%).

Anita Naik, Lifestyle Editor at VoucherCodes.co.uk, commented: “A year on from the first national lockdown, this research proves just how much of an impact the pandemic has had on our finances and our concerns around money. It’s particularly worrying to learn that more than a third of us have had anxieties about finances every day this year.

“With many of us feeling daunted about managing money after lockdown, now is the perfect time to put in place some simple habits that will help keep your finances in order. These are my top three tips:

1. Regardless of your financial situation, it’s always worth shopping around to find the best deals on the things you need to buy. Installing a free browser extension such as DealFinder from VoucherCodes will make this really easy as it automatically finds and applies the best discount codes available – a quick and simple way to make sure you get the most out of your money every day.

2. Many banking apps now allow you to set spending limits to help you keep a secure grasp on your monthly spending throughout the month – so if you’re particularly bad at budgeting this simple feature will make sure you don’t overspend. You can also set up account balance alerts, so if you’re getting close to going overdrawn you’ll get a notification to ensure you can take action.

3. If you are able to, setting up a direct debit to your savings account will help ensure you keep some money back for things you really need – it’s often helpful to do this at the start of the month so you don’t end up spending it by accident. Many of us really struggle to save, but even as little as a few pounds each week will add up.”