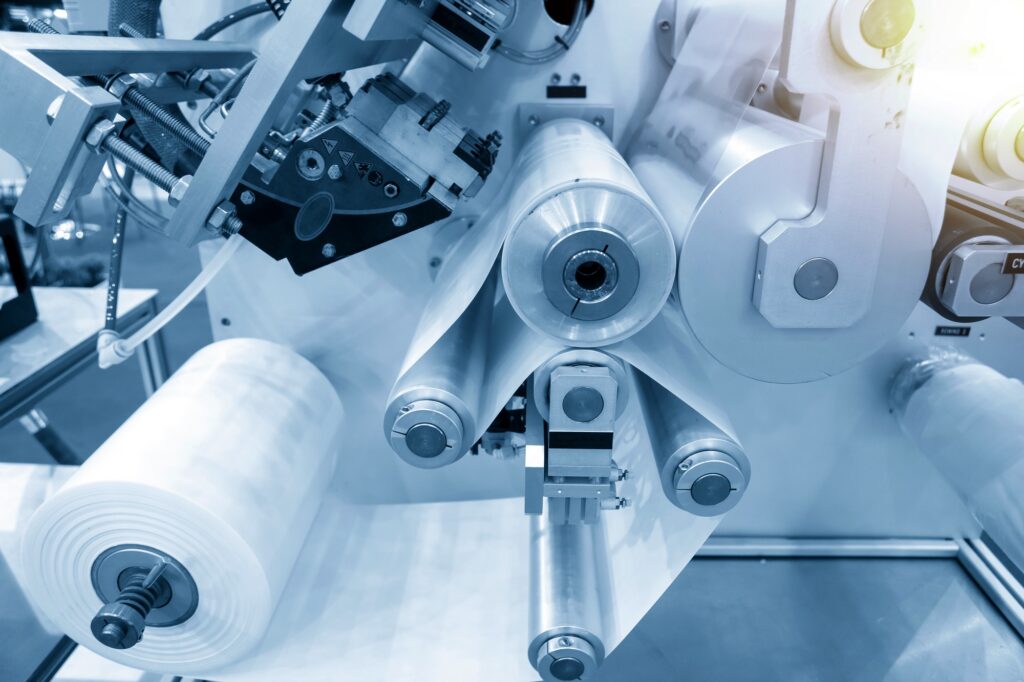

Incomlend Invoice Financing Programme Helps China-based Packaging Manufacturer Capitalise on Global E-commerce Boom

Global invoice financing marketplace, Incomlend, announced an invoice financing facility for an established China-based company in the packaging manufacturing sector. The solution allows the manufacturer to finance the increased production of mailer packaging and capture more revenue opportunities as delivery services flourish across e-commerce during Covid-19.

Traditionally, the manufacturer can take up to 90 days to cash in an invoice. Incomlend offers a quick turnaround invoice financing solution that can free up working capital for small and medium enterprises (SMEs), such as the packaging manufacturer, to cash in an invoice as early as three days after goods are shipped. Founded in Singapore and with offices in Europe, India, and Southeast Asia, Incomlend connects SMEs globally with communities of investors, enabling them to buy and sell individual invoices in an invoice exchange platform.

Most of the packaging manufacturer’s current clients are based in the United States. They include a leading sourcing service provider that works with some of the world’s biggest e-commerce and retail players. With access to cash flow, the manufacturer can now use the funding to accelerate its production momentum and significantly boost its output. Due to the unprecedented surge in e-commerce, the company predicts its output value will more than double in 2021, compared to last year.

E-commerce has experienced a worldwide boom since the onset of the pandemic. The sector is seeing a surge in online sales as retail closed its doors in many markets. According to Statista, over 2.1 billion people worldwide will purchase goods and services online in 2021, up from 1.7 billion in 2016. This reflects a demand uptick for packaging products from e-commerce players.

Incomlend CEO and Co-founder Morgan Terigi said: “E-commerce and delivery activities have surged dramatically over the last year. We see no signs of this trend stopping even as retailers gradually re-open their brick-and-mortar stores. Our quick turnaround invoice financing solutions are designed to empower SMEs with growth ambitions, presenting a future full of new revenue opportunities for packaging players. We provide them with the funding they need to rapidly scale up their operations and capture a larger slice of this growing market.”

Headquartered in Singapore, Incomlend gives SMEs access to technology-enabled working capital solutions that industry-leading institutional investors support. The company’s scalable business model also gives accredited and institutional investors access to international trade invoices with stable and steady, risk-adjusted returns. Since it started operations in 2016, Incomlend has financed over USD500 million (CHF 451 million) in trades across 50 countries worldwide.

For more information on Incomlend, please visit https://www.incomlend.com/.