How will digital payments affect freelancers in 2022?

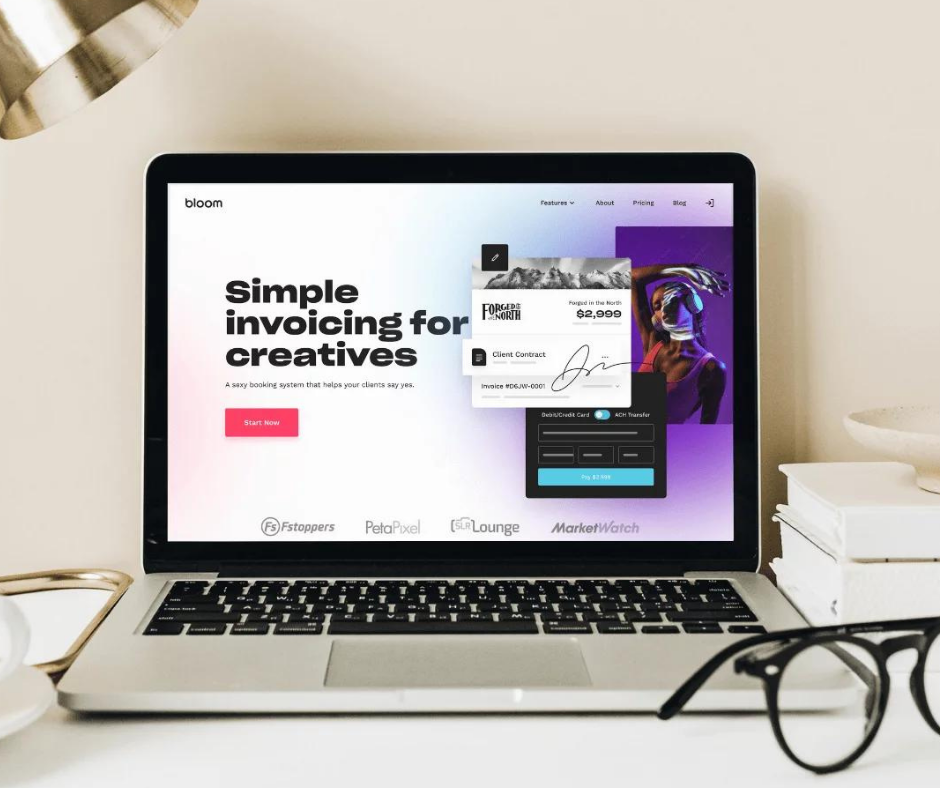

Written by Paul Mikhaylenko, CEO and Co-founder of Bloom.io

Why Digital Payments Are Trending in 2022

There are four main ways of how freelancers get paid. 50% of freelancers still require checks or cash, outdated methods that no clients appreciate. Many others use Venmo and CashApp, tools that are casual and unprofessional. Merchant tools, such as Stripe or Square are intended for developers or retail shops. Finally, others use financial tracking tools like Quickbooks or Freshbooks, offering an experience that is dated and complicated. There are many invoicing tools, but none of them are built for creatives. In fact, many payment processing platforms keep at least 1.3% to 3.5%, plus the payment processor’s cut. For freelancers, this can add up quickly and leave them with minimized earnings. Digital payments are on the rise as freelancers that use electronic payment systems are getting paid faster. Keeping track of invoices, tax information, and transactions is vital to any business, especially freelancers. The old school payment methods that once prolonged the payment process, and complicated tools are becoming a burden of the past.

Freelance Revolution Predicted to Skyrocket

The pandemic birthed the new freelance revolution that is predicted to grow immensely in 2023. According to CEO of Bloom.io, Paul Mikhaylenko, highly skilled professionals will choose freelance work over traditional employment because technology has matured to give back to creatives. While freelancing has had a negative reputation in the past, often referred to those who couldn’t find full-time work, that stigma is far from true today. In fact, the workforce is now made up of 59 million freelancers in the US alone. With the online working revolution, the need for digital payments is undeniable.

Freelancers Measure Effectiveness of Digital Payments

Owners of a successful wedding photography studio in New York, Ryan and Heidi, once used old school payments methods. Wedding photography wasn’t always the plan for founders of Forged in the North, a successful collective studio based in NY. What started as architects with cameras turned into professional wedding photographers with a million dollar studio. Today, they are recognized as some of the best wedding photographers in the world by Brides Magazine. As of January 2022, the couple has seen incredible growth in their studio. They have a message for all freelancers: leverage modern digital payments and streamline your business professionally because it makes all the difference. Their story wouldn’t be complete without ongoing vision. The true reward for the founders is lifelong client relationships, creating with like-minded artists, and inspiring creatives to succeed. Last but not least, they attribute a portion of their profitable business to robust invoicing and digital technology.

About the author

Paul Mikhaylenko, CEO and Co-founder of Bloom.io, the suite of business tools that’s designed to help creative business owners get back to their art and earn more money. Paul started as a musician, photographer, and a singer, earning money on side projects for many years before diving into building tech.