Women in UK finance industry earn 30% less than men, according to Spendesk research

New CFO Salary Benchmark study – conducted in Europe and the US – reveals gender pay gap persists across all levels of the financial sector

Spendesk, a 7-in-1 spend management solution for SMEs, has today shared the findings of a survey carried out with the global finance community CFO Connect looking at the salaries of business finance leaders of all levels in Europe and the US.

In the UK specifically, the findings revealed women are paid on average 30% less than men for the same finance roles. Most telling is the slow progress being made when it comes to younger professionals. Women joining a finance role in the UK today can still expect to be paid 24% less than a male counterpart.

Gender pay gap still exists in Europe and the US

The new CFO Salary Benchmark research by Spendesk through CFO Connect, reveals that overall, men in the finance industry across Europe and the US earn 13% more than their female peers, although the gap is much wider in countries like the UK (30%) and Germany (29%). In the UK specifically, the average female finance worker earns £89,000/€104,000, while her male equivalent earns £116,000/€135,000.

The pay gap is different depending on roles, with more senior positions being more closely aligned. For example, the average salary across Europe and the US for a female Chief Finance Officer (CFO) is £112,000/€131,500, whereas the male equivalent averages at £116,000/€136,000 – a gap of 3.5%. In contrast, at mid-level, there is a pay gap of 22% for Financial Planning Managers, with the average salary for a female in that role at £50,000/€59,000 compared with £62,000/€72,000 for her male counterpart.

Overall, women aged between 25-30 can expect to be paid 24% less than men of the same age. Between the ages of 30-40 the gap is less – at 10% – whereas, between 40-50, the pay gap widens again, with female seniors earning 20.5% less than their male peers.

Major variations in finance industry salaries across Europe

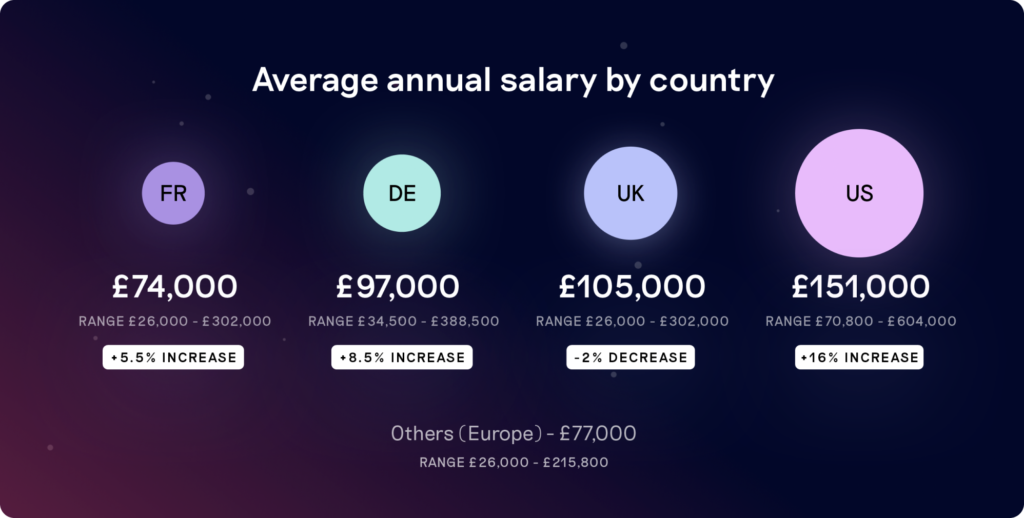

The regional difference in average salaries for finance roles between the UK and the rest of Europe has narrowed compared with 2021. Average yearly salaries by country shows:

- Average salary per year in France is £74,000/€87,000, whereas the UK boasts the highest in the region at £105,000/€122,500.

- Overall highest average salary still remains in the US, with almost £151,000/€175,000 per year, which is 43% higher than the UK.

- Germany follows the UK in Europe at almost £97,000/€113,000, with The Netherlands close behind at £94,000/€109,500.

- Following France is Italy (£73,000/€85,000), Austria (£62,000/€73,000), Spain (£60,000/€70,000), and Portugal (£41,000/€48,000).

Despite these salary variations, almost two-thirds (65.4%) of all finance professionals surveyed feel they are fairly compensated – although there are differences of opinion between male and female employees. Just over half (55%) of men are happy with their pay, while more than two-thirds (67%) of women feel they are fairly compensated – even though on average the latter are paid less.

Other key findings in the study include:

- The salary growth rate in the UK is in decline at -2%, compared to France, which increased by 5.5%, and Germany by 8.5%. Overall, the US has the highest growth at 16%.

- There are significant differences between market rates despite fewer geographical constraints and remote work possibilities, especially between the US and Europe.

- The study also shows that older, more established companies tend to pay more compared to new companies.

- Larger companies, especially those with more than 250 employees, also lean towards higher salary offerings.

Reflecting on the findings, Rodolphe Ardant, Founder and CEO at Spendesk said, “The persistent gender pay gap should be a concern for all businesses, who clearly need to do more to create a fairer salary scale. It’s a particularly pressing issue now, with a tight labour market and employees in a position to demand better treatment from their employers. Employers who don’t offer fair pay and flexibility to their staff risk alienating the best and brightest talent they desperately need to ensure continued growth.”