3 Long-term Trading Strategies for Forex Traders: Old & New Strategies

Most forex traders tend to use short-term strategies like scalping because of its profit potential. However, long-term strategies can generate a lot of profit as well. Some argue that the benefits of long-term forex trading are better than short-term trading.

These tried-and-true strategies increase traders’ potential for long-term success. They get a better idea of the bigger picture that short-term traders might not understand, which can help them make consistently profitable trades.

Plus, it teaches discipline, emotional control, and objective reasoning since you will have to deal with short-term price fluctuations.

If you want a successful long-term career as a forex trader, these strategies can push you closer to your goals.

Best Forex Long-term Trading Strategies

Here are the most common and effective long-term forex trading strategies:

1. Price Action Trading Strategy

The price action strategy is perhaps one of the forex market’s most common long-term trading strategies. Price actions refer to the study of price movements. Since most fundamental analysis and technical indicators are based on market price action, traders decided to study and learn from the price itself.

Therefore, the price action trading strategy involves studying the price of an asset to make technical trading decisions. While it can be used as a standalone method, it is typically used along with a technical indicator for added accuracy. It is also relatively easy to use if you are just getting started in the forex market.

The moving average is the most common technical indicator used along with the price action trading strategy.

When the price action strategy is combined with a couple of MAs, it helps to identify key areas of support and resistance and determine the strength of the prevailing trend.

Relevant Elements for Price Action Trading

For a price action trader, there is nothing more important than price and time. So, the price chart is the most essential tool for a price action trader, not technical indicators.

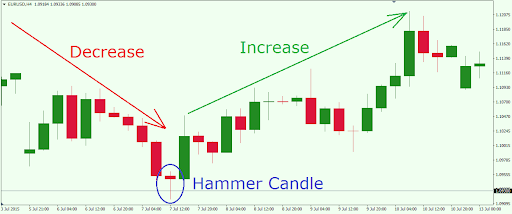

The candlesticks, which are one of the main elements of a price chart, give all the details about the price that you need. It indicates a currency pair’s high, low, opening, and closing prices for a certain time. Also, these candlesticks tend to come in different sizes and shapes to reveal the market direction.

For instance, some candles, like the hammer, are referred to as bullish signals, while others like the hanging man, are bearish signals. Chart patterns are another element of a price chart that price action traders consider.

If these patterns are spotted, interpreted correctly, and combined with trading risk management, they can point out lucrative trading opportunities in the market.

2. Order flow trading Strategy

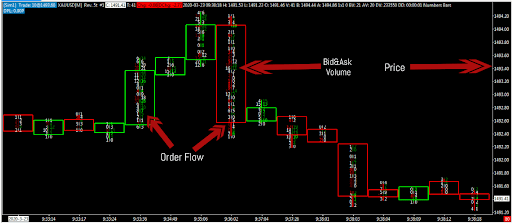

Order flow trading or tape reading is a technique that involves analyzing the flow of unexecuted trading orders and their later impact on future price movement. In other words, it is a trading analysis method that helps traders predict future price imbalances or fluctuations.

This strategy is popular among traders because of its insight into what is going on behind the price chart. Order flow trading gives you information about:

- Big buy and sell orders that can impact the market price

- Liquidity flow of unexecuted orders

- Exhaustion of market momentum

- Momentum buying and selling

This information is displayed on something called the order book, which is a list of all unexecuted trading orders.

It provides a microscopic view of the finer details behind buying and selling volume. Plus, understanding order flow trading allows you to enter the market with increased precision and accuracy.

Combined with technical indicators, this strategy gives you a better picture of the market forces and increases your trading flexibility. However, the use of indicators is not required.

How to Use the Order Flow Trading Strategy

The order flow trading strategy involves analyzing unexecuted orders and making trading decisions accordingly. The purpose of using this strategy is to spot market imbalances that will enable you to determine areas of high buying and selling pressure.

Every trading day is a battle between buyers and sellers for dominance in the market, and order flow trading puts you at the frontline. Therefore by learning how to analyze the order book and use the order flow trading strategy, you will gradually develop a sixth sense for price fluctuations.

Let’s look at it this way.

You are trading the currency pair GBP/USD, but the market has been moving slowly; there hasn’t been any significant market news to impact movement or fluctuations to provide trading opportunities. But when you look at the order book, you notice a large buying order for 2 million lots for the base currency GBP.

Considering the currency pair’s liquidity, such a large order might not be unusual. Still, an institutional investor or government entity typically places this type of order. For a retail trader, spotting this large order provides an opportunity for you.

To take advantage of such an order’s impact, you can execute a trade in the direction of the order.

It will be harder for government agencies and major investors to hide their trades. It also becomes easier to notice the exact moment economic news impacts the market, and you get to be among the earliest traders to benefit from market changes before the momentum slows down or reverses.

Risk of the Order Flow Trading Strategy

This strategy has stood the test of time and remains one of the best ways to get reliable market information. It is also not limited to the forex market and can be used for trading stocks, options, and futures. But it does have its limits.

Few trading platforms provide the level 2 market data needed for order flow trading. In many cases, access to the market data is restricted to certain assets, and even then, you might still not have access to the data.

Also, learning how to properly read and use the data for trading takes some time. So, before anything, extensive research is needed to discover which brokers offer you access to level 2 market data. You also have to decide on the industry or market to trade in before finding the best trading platform for reading market data.

3. The 5-3-1 Trading Strategy

The 5-3-1 trading strategy is not your typical trading strategy that requires price charts and technical indicators. Instead, it is a strategy focusing more on developing a sound trading structure and principles. The 5-3-1 trading strategy is among the best long-term strategies traders can use because it helps to maintain discipline and follow a well-defined structure to achieve the best results.

By providing a focused approach to trading, this strategy prevents traders from becoming overwhelmed by the bulk of information in the market and can channel their attention to the most profitable trades.

How the 5-3-1 strategy works

How the 5-3-1 strategy works

The numbers five, three, and one represent key steps in the strategy. They stand for:

Five (5)

There are more than 180 currency pairs in the forex market, but not all are great for trading. These minor currency pairs offer low liquidity, high spreads, and not enough volatility to make profitable trades. Since you can use only five currency pairs, choosing from popular pairs like EUR/USD, GBP/USD, USD/JPY, and many more is advisable.

Before selecting a currency pair to trade with, consider the trading volume, volatility, and strength of the economy behind it. If you already have some knowledge of the market, choose assets that you are most familiar with and work best for your time zone. For instance, if you stay in Australia, you can choose pairs like AUD/USD, AUD/JPY, EUR/AUD, etc.

Three (3)

For this next step, you are required to use three trading strategies only. This also applies to your choice of technical indicators and trading style. Using multiple forex trading strategies gives you enough room to diversify your approach and manage risk without getting overwhelmed. With different trading strategies, you can adapt to the volatile nature of the market and take advantage of complementary relationships.

Here, you can choose strategies like level 2 market data strategy, scalp trading strategy, swing trading strategy, chart pattern analysis, or any strategy specific to your needs.

One (1)

The best part about the forex market is that it is open 24/7. So, you can choose what time works best for you with little to no limitations. By focusing on just one trading session, traders can pinpoint the best opportunities and trading setups to increase their profitability.

However, failing to trade as scheduled may lead to missed opportunities or the market moving against your position.

The time frame you choose for trading depends on your trading style and location. For example, breakout traders might choose hours with increased volatility. Traders who enjoy trading in ranging markets may choose times with low trading volume and volatility.

Conclusion

Every strategy has its benefits and risks. But the best long-term strategy emphasizes discipline, patience, diversification, and effective risk management. Before you choose a strategy, ensure that it suits your trading style, goals, time horizon, and risk tolerance.

It also helps if it can be used in different market conditions and incorporates technical and fundamental analysis.

Once you have found a strategy that suits your criteria, it is always advisable to backtest it and practice with a demo account before using it to trade.